Traders Blog - Analysis, Strategies, News and more

Wall Street ended last week lower!

Producer inflation increased the recession concerns.Ahead of CPI data on Tuesday and the FOMC interest rate decision meeting on Tuesday and Wednesday, the risk of recession seems more serious with Jobless claims and PPI data. While last Thursday...

Crypto market, Caution, and Natural!

BTC is back above 17K, but overall cryptocurrency market capitalization is down about $840 billionAfter cooling tensions and overall market sentiment, the overall crypto market edged higher in the second part of last week. In contrast, during this we...

Loonie after BoC rate hike!

USDCAD and Thursday's employment numbers. On Wednesday, the Canadian central bank raised the rates by 50 basis points, as was widely expected. This is while the Reserve Bank of Australia already started slowing the pace of rate hikes and raised...

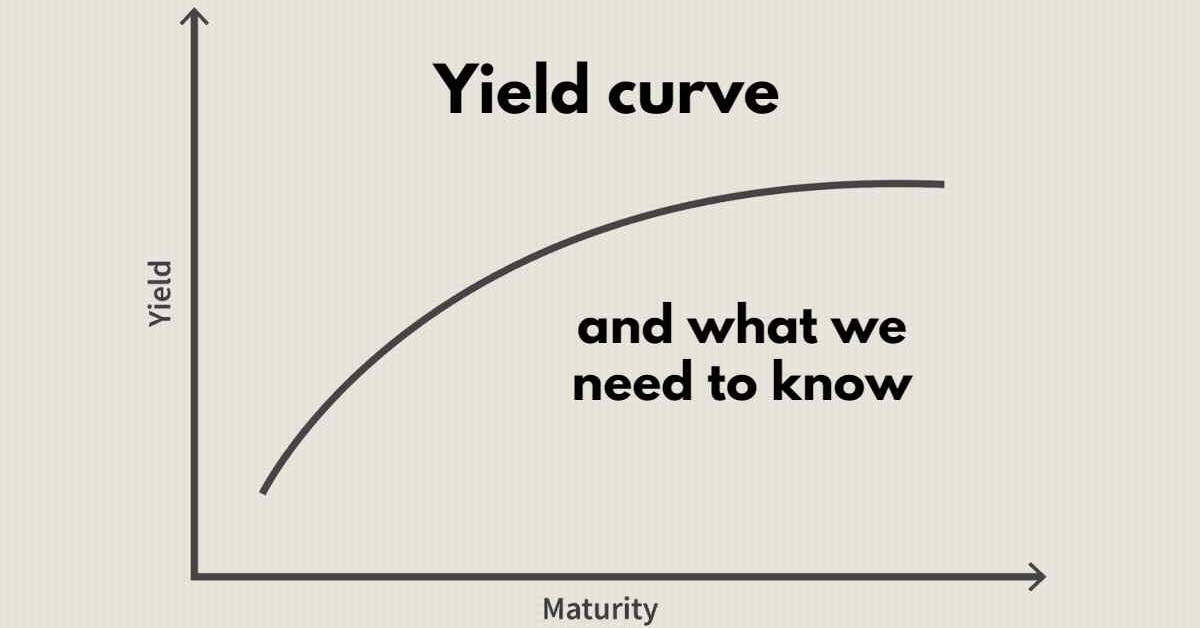

The yield curve and what we need to know

Higher risks and lower bonds are what we can guess with more probability.The yield curve graphs the relationship between bond yields and bond maturity. It captures the perceived risks of bonds with various maturities to bond investors. (Investopedia)...

Oil ignoring weekly inventory reports.

EIA lowered its demand, and fear of recession increasedLike every Tuesday and Wednesday, we had API and EIA weekly inventory reports. According to Tuesday's American Petroleum Institute report, the levels of US crude oil inventories fell by -6.426M b...

Tags

Subscription